ASID Interior Design Billings Index (IDBI) July 2021

Billings, Inquiries and Outlook Drop in July, but Maintain Positivity

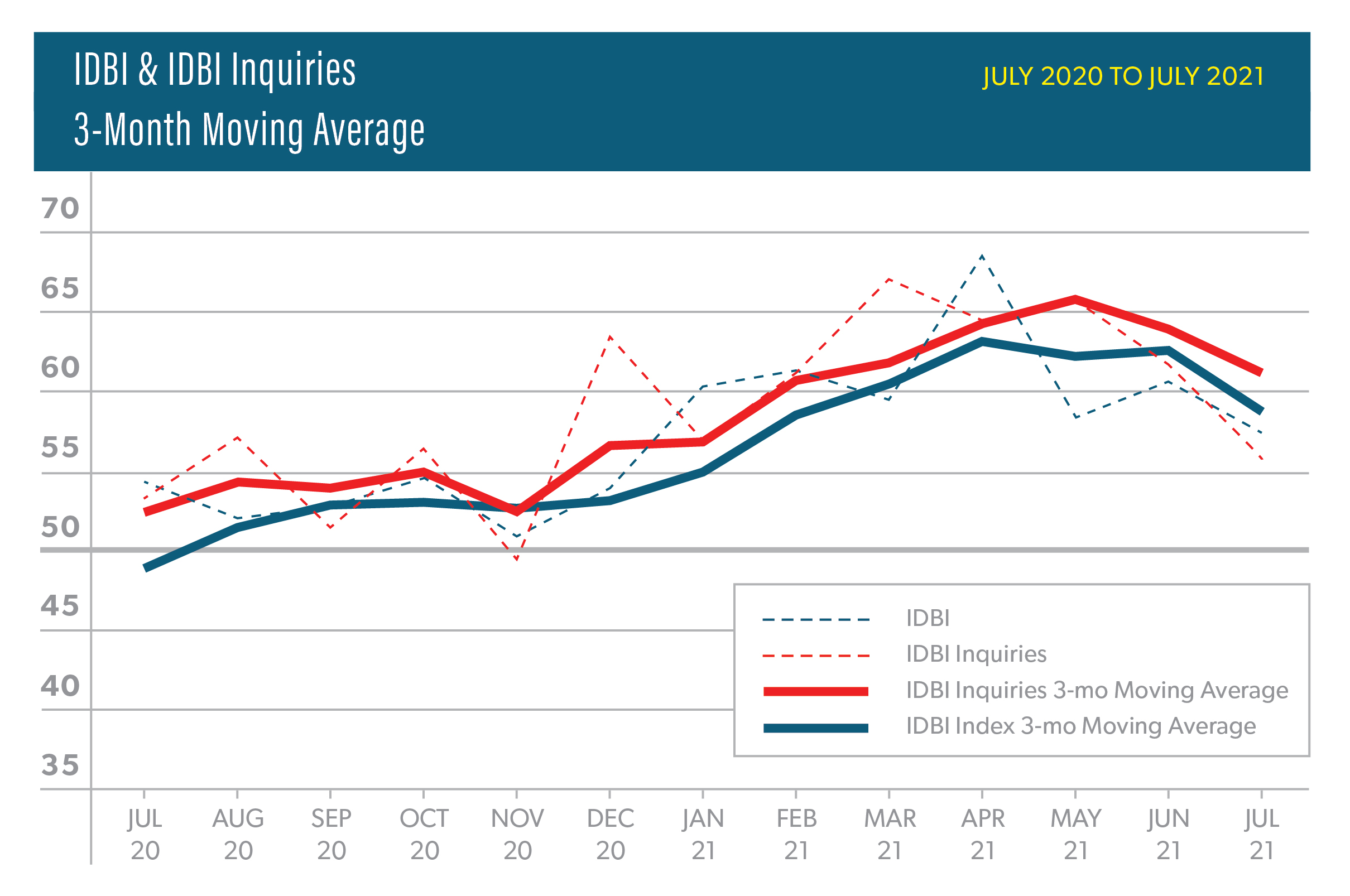

- July business performance showcased a predictable cooling-off from the record highs experienced over the last couple of months, but still displayed signs of growth.

- Billings index* decreased by 3.1 points to 57.5 for July, down about 11 points from the record-setting month in April (68.6).

- Even with this decline and registering its lowest reading in 2021, overall business performance records its 13th consecutive month in expansion territory (i.e., above 50).

- Historically, summer months (Jun-Aug) tend to be less busy for firms and have recorded a dip in billings from June to July.

- While interior design business performance in the South continues to fluctuate, experiencing at least a nine-point difference between surveys for the fourth consecutive month (June: 70.0 and July: 54.9), the three-month moving average (61.8) for the region is still the highest (Midwest: 59.0, Northeast: 59.5, West: 58.8).

- Inquiries index* decelerated 5.9 points to 58.9, but still growing at a relatively high rate.

- Similar to billings, inquiries have historically recorded slight dips from June to July, providing strong evidence for cyclicality.

- The future of interior design business is still bright as the six-month outlook continues to read higher than billings and inquiries even though it dropped 3.0 points to 62.5.

- Panelists have mentioned product concerns (e.g., availability, costs, storage) as potential contributors to a lower outlook.

- Billings index* decreased by 3.1 points to 57.5 for July, down about 11 points from the record-setting month in April (68.6).

- Concerns surrounding COVID-19 has risen to 3.14 in July from 2.68 in June (1- No concern/Business as usual to 5- High concern/Anxiety from disruption and unknown) which is the largest month-over-month increase since the question’s inception starting in March 2020.

- When asked about new building construction (residential and/or commercial) impacting project inquiries in their area, 33% expressed a positive impact while 19% indicated a negative one.

- Panelists mentioned that they “have more work than ever” while others cite various reasons, such as funding, material availability/pricing, and scheduling issues, for projects being on hold or delayed.

Categories

Interior Design Billings Index (IDBI)